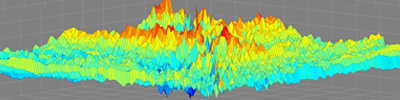

Identifying Structure

in the noisy data of markets

Over 20 Years in the Industry

One of the longest established European Systematic managers

Multidisciplinary Quant Team

Our strategies are formulated and directed by the best professionals in the fields of finance, mathematics and physics

Over 20 Years in the Industry

One of the longest established European Systematic managers

Longevity Through Evolution

About IKOS

Established in 1991, IKOS is one of the first European systematic asset managers. Today, IKOS operates a global infrastructure from its head office in Cyprus utilizing execution sites and facilities in New York.

IKOS creates and executes trading strategies based on mathematical modelling statistical analysis, factor analysis and exploitation of multiple time horizon effects. Econometric models are combined with time-series analysis and market micro-structure models within an integrated risk management and systematic high-frequency execution platform. For many years IKOS has delivered excellent long-term returns with low correlation compared to other hedge funds, CTAs and traditional asset managers.

The IKOS team offers a wealth of experience in sophisticated quantitative investment management, coupled with world-class mathematical, scientific and technical skills. IKOS’ institutional framework, enterprise-scale operation, portfolio construction, execution, reporting and management systems have been developed and refined over many years, to meet the specific needs of leading institutional investors.

IKOS is a signatory to the Standards Board for Alternative Investments (SBAI) (formerly Hedge Fund Standards Board (HFSB)), as well as a member of the Alternative Investment Management Association (AIMA), which are considered leading advocates for sound business practices. Furthermore, the IKOS funds have been certified by Amber Partners, most recently in 2014.

Pioneers of Systematic Trading

History of IKOS

1991

Founding of IKOS

- The first IKOS company is established in 1991 by Elena Ambrosiadou, and investment management activities commence in 1992

- The IKOS master-feeder fund structure is launched in 1995

1998

Evolution of investment process

High-speed broker links

- IKOS’ portfolio construction algorithms are re-engineered

- Growth and technological advancement

- IKOS invests significantly in people and infrastructure

- Trading systems developers are recruited

- High-speed connections with brokers are established

- Dedicated execution platform is implemented

- Execution optimization algorithms are developed

Implemented a dedicated trading platform

- US and European equities added to strategies in 1998

- IKOS’ multi-strategy program combining futures and equities is launched

Expansion of trading universe

2004

Order execution enhancements

- Creation of a dedicated Execution Systems Team

- Development of algorithms to handle the execution of Alpha models

- Designing a new trading platform and market data collection application.

Managed Account platform

- Developed Managed Account systems

2006

Distributed trading

Distributed trading infrastructure at Equinix NY4 and LD4

2009

Futures platform

Release of the second version of the trading platform infrastructure for futures

2011

New models

Addition of new types of models and expansion of system parameterisation

2012

Spot FX

Development of next generation analysis and forecasting systems platform for spot currencies

2013

IKOS New Head Offices

New portfolio construction platform

- Re-engineering and rollout of new portfolio construction system for all asset classes

- Better code management and versioning framework

- Research-related synergies, including streamlining of model development and integration

- Development of existing models and addition of new models

- New low-latency infrastructure and market data provider

2015

Further development of executions platform

- Release of the new trading platform and tick-by-tick simulation framework, delivering greater speed and increased capacity while utilizing fewer resources

- Introduction of advanced monitoring, simulation and administration tools

- Expansion of our FX liquidity pool and introduction of new execution rules

- Implementation of an advanced FX aggregator

- Addition of multiple intraday strategies hosted in the trading platform